LTC Price Prediction: Analyzing the Path to $200 Amid Technical and Fundamental Crosscurrents

#LTC

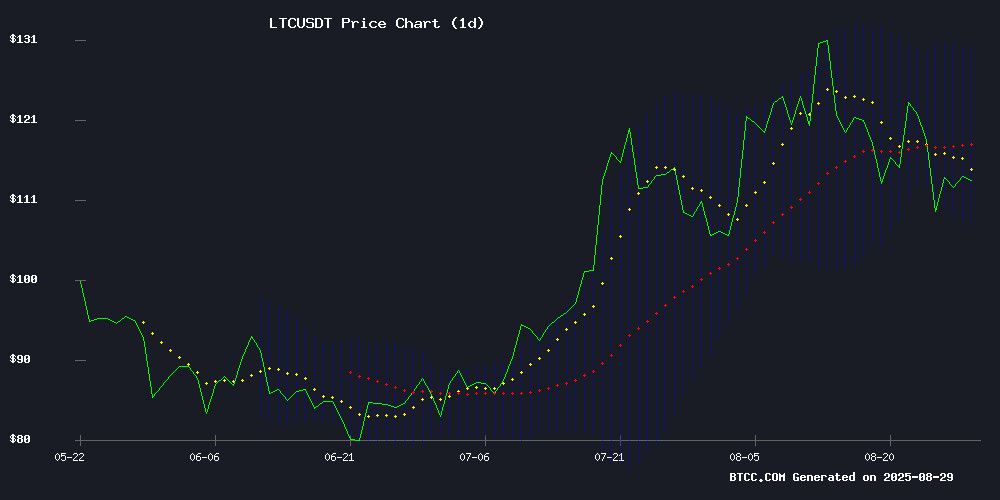

- Technical Resistance Levels: LTC faces immediate resistance at the 20-day MA ($118.46) and upper Bollinger Band ($130.18), needing to break these levels decisively

- Institutional Adoption Growth: Corporate treasury expansion and regulated mining platforms provide fundamental support for long-term price appreciation

- Regulatory Environment: Increased scrutiny on insider trading could create short-term volatility despite positive institutional developments

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Below Key Moving Average

Litecoin is currently trading at $109.49, sitting below its 20-day moving average of $118.46, which suggests near-term bearish pressure. The MACD indicator shows a positive reading of 5.85, with the signal line at 2.55 and histogram at 3.29, indicating some bullish momentum remains intact. Bollinger Bands position the price NEAR the lower band at $106.73, with the middle band at $118.46 and upper band at $130.18, suggesting potential support levels.

According to BTCC financial analyst Emma, 'LTC's position below the 20-day MA indicates short-term weakness, but the positive MACD suggests underlying strength. A break above $118.50 could signal renewed bullish momentum.'

Market Sentiment: Institutional Interest Grows Amid Regulatory Developments

Recent news highlights significant institutional movement in the Litecoin space. Luxxfolio's filing to raise $73 million for Litecoin treasury expansion demonstrates growing corporate adoption, while SolMining's UK-regulated cloud mining platform launch adds legitimacy to LTC mining operations. However, Fortune's report on crypto treasury boom triggering insider trading concerns introduces regulatory headwinds.

BTCC financial analyst Emma notes, 'The institutional adoption news is fundamentally positive for Litecoin, but regulatory scrutiny could create short-term volatility. The market is balancing between growth opportunities and compliance challenges.'

Factors Influencing LTC's Price

Luxxfolio Files to Raise $73M to Expand Litecoin Treasury Strategy

Canadian crypto infrastructure firm Luxxfolio has submitted a preliminary shelf prospectus to raise up to CAD$100 million ($73 million) as it doubles down on its Litecoin-focused corporate strategy. The filing, made with Canadian regulators outside Québec, allows the company to issue various securities over a 25-month period.

The move follows Luxxfolio's July pivot to become the first publicly traded company to anchor its treasury in Litecoin. The firm has disclosed plans to accumulate 1 million LTC by 2026, with Litecoin creator Charlie Lee now serving on its advisory board. "Scale is critical in our sector," said CEO Tomek Antoniak, framing the capital raise as essential for capturing market share.

Despite its ambitions, Luxxfolio faces significant financial challenges. The company has warned of survival risks without fresh funding, reporting mounting losses even as it positions itself as a Litecoin adoption pioneer. The proposed fundraising WOULD provide runway to stabilize operations while executing its aggressive LTC accumulation strategy.

Crypto Treasury Boom Triggers Insider Trading Concerns – Fortune Report

Unusual stock movements ahead of cryptocurrency announcements at several small-cap companies have raised eyebrows, with experts drawing parallels to classic insider trading patterns. MEI Pharma's shares nearly doubled before disclosing a $100 million Litecoin (LTC) acquisition, while SharpLink saw similar activity prior to a $425 million Ethereum (ETH) revelation. These cases highlight regulatory challenges in crypto-related disclosures compared to traditional finance.

Finance professor Xu Jiang of Duke University noted the suspicious timing, stating such patterns frequently accompany insider trading scenarios. The incidents follow Binance's recent suspension of an employee over alleged insider trading tied to a token launch, underscoring ongoing compliance challenges across the industry.

SolMining Launches UK-Regulated Cloud Mining Platform for Bitcoin, Dogecoin, and Litecoin

SolMining, a UK-registered entity under SOL INTERNATIONAL LIMITED, has introduced a cloud mining platform targeting Bitcoin (BTC), Dogecoin (DOGE), and Litecoin (LTC). The service aims to simplify passive income generation by eliminating hardware mining complexities like electricity costs and maintenance.

The platform emphasizes legal compliance and transparency, with clearly defined contract terms, daily blockchain-auditable settlements, and multi-signature cold wallet security. Its 'compliance first' approach includes AI-driven risk monitoring and adherence to UK regulatory standards.

Will LTC Price Hit 200?

Based on current technical indicators and market developments, reaching $200 represents a significant challenge that would require substantial bullish catalysts. At the current price of $109.49, LTC would need to appreciate approximately 82% to hit the $200 target.

| Metric | Current Value | Required for $200 |

|---|---|---|

| Price | $109.49 | $200.00 |

| Percentage Gain Needed | - | 82.6% |

| Distance from 20-day MA | 7.6% below | 68.8% above |

| Bollinger Upper Band | $130.18 | 53.6% above current upper band |

BTCC financial analyst Emma states, 'While institutional adoption through treasury strategies and regulated mining platforms provides fundamental support, the technical picture suggests $200 is unlikely in the immediate term without significant market catalysts or broader crypto bull market conditions.'